On 16 May, it was reported that the Korean financial regulators have approved DGB Daegu Bank to become the 7th commercial bank in Korea.

DGB Daegu Bank is the core entity of DGB Financial Group (139130 KS) which currently has a market cap of 1.4 trillion won (US$1.0 billion).

This change will allow the company to expand in the more lucrative metropolitan Seoul and other regions in Korea. We have a positive view of DGB Financial Group (139130 KS).

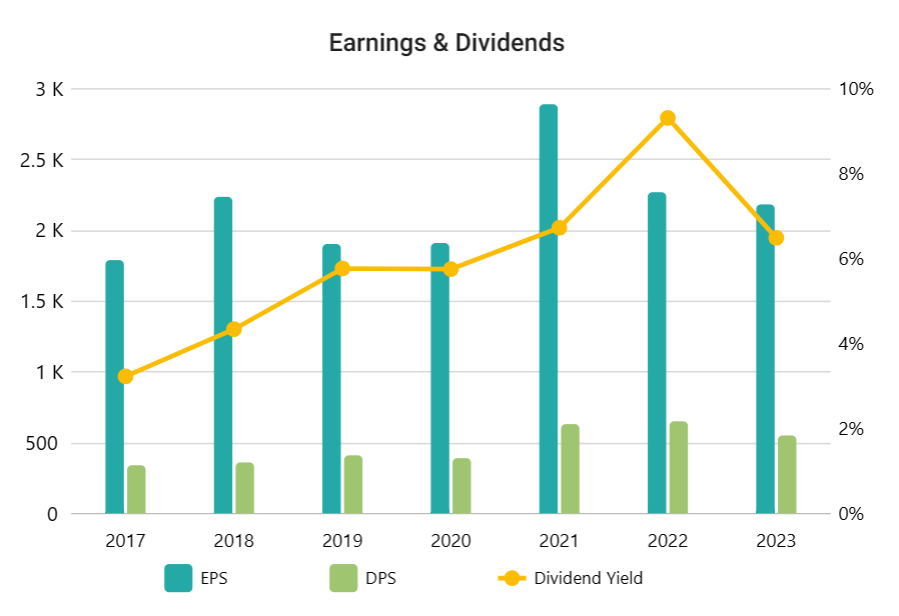

DGB Financial's dividend yield averaged 6.8% from FY 2019 to FY 2023.

Conclusion First

On 16 May, it was reported that the Financial Services Commission (FSC) has approved DGB Daegu Bank to become the 7th commercial bank in Korea. DGB Daegu Bank will be the first new commercial bank to be launched in Korea in 32 years. The company plans to change the name of the bank from DGB Daegu Bank to iMBank in June.

We have a positive view of DGB Financial Group (139130 KS). The company will become the 7th commercial bank in Korea allowing the company to compete on a national basis in Korea. This change will allow the company to expand in the more lucrative metropolitan Seoul and other regions in Korea.

Given its nationally recognized commercial banking status, many investors could start to put higher valuation multiples on DGB Financial Group as national commercial banks tend to receive higher valuation multiples than the regional banks in Korea.

DGB Financial Group is also one of the key beneficiaries of the Corporate Value Up program in Korea, given its low valuation multiples.

DGB Daegu Bank's Plans to Expand Nationally - According to DGB Daegu Bank, it plans to open 14 new branches in Seoul, the Chungcheong provinces and Gangwon Province in the next three years. DGB Daegu Bank is becoming a national commercial bank in Korea which is likely to increase the competition in the banking sector, although the degree of additional competitive threat by DGB on the current market leaders including KB, Shinhan, and Hana is not likely to be overly threatening.

DGB Financial Group DPS, Dividend Yield, & Dividend Payout

DGB Financial's dividend yield averaged 6.8% from FY 2019 to FY 2023. Its annual dividend payout averaged 23.5% in the same period. The company's DPS ranged from 390 won to 650 won in the past five years. The company's dividend yield increased from 6.7% in 2021 to 9.3% in 2022 but declined to 6.5% in 2023. According to the consensus estimates, the current dividend yield of DGB Financial is 7.6% in 2024.

DGB Financial Group EPS, DPS, and Dividend Yield (Source: Smartkarm

DGB Financial Group Shareholder Return Policy - The charts below provide the shareholder's return policy of DGB Financial Group. Total shareholder returns (TSR) ratio has been rising in the past three years, from 22.8% in 2021 to 27.4% in 2022, and 28.8% in 2023. Cash dividends accounted for 82% of TSR in 2023 and share buyback accounted for the remaining 18%.

DGB Financial Group Shareholder Return Policy (Source: Company data)

Keep reading with a 7-day free trial

Subscribe to Asian Dividend Stocks to keep reading this post and get 7 days of free access to the full post archives.