O Ta Precision Industry is a company based in Taiwan that mainly makes golf clubs for global golf equipment branded companies including Titleist, PXG, Mizuno, and Honma.

O-Ta Precision's dividend yield averaged 9.2% annually from 2019 to 2022. Its annual dividend payout averaged 68.5% in the same period.

We like the company's strong niche in the golf club OEM/ODM business with excellent list of customers with its its historically high dividend payout ratio and dividend yields.

Conclusion First

O Ta Precision Industry Co (8924 TT) is a company based in Taiwan that mainly makes golf clubs for global golf equipment branded companies including Titleist, PXG, Mizuno, and Honma. O-Ta Precision Industry currently has a market cap of 7.4 billion TWD (US$238 milion).

O-Ta Precision's dividend yield averaged 9.2% annually from 2019 to 2022. Its annual dividend payout averaged 68.5% in the same period. Due to decline in earnings this year, if we assume 69% dividend payout (historical average), this would suggest dividend yield of 4.3% in 2023 and 5% in 2024.

Although the global golf equipment market is not expected to grow as fast as during the COVID-19 pandemic period in 2021 and 2022, the global golf equipment market is expected to grow at a CAGR of 2.3% per year from 2022 to 2033 (reaching $18.9 billion).

The company has been consistently profitable and although its sales growth is poor this year, we think that this has mostly been reflected its share price declining nearly 50% from its peak about two and half years ago. The company has a strong balance sheet. Net cash was 2,213 million TWD at the end of 3Q 2023, which represents 30% of its current market cap.

All in all, we like the company's strong niche in the golf club OEM/ODM business with excellent list of customers such as Titleist and Honma combined with its its historically high dividend payout ratio and dividend yields.

O-Ta Precision Industry DPS, Dividend Yield, & Dividend Payout

O-Ta Precision's dividend yield averaged 9.2% annually from 2019 to 2022. Its annual dividend payout averaged 68.5% in the same period. The company's DPS ranged from TWD 3.8 to TWD 12.9 in the past four years. The consensus estimates the company to generate EPS of TWD 5.54 in 2023 and TWD 6.44 in 2024. If we assume a 69% dividend payouts, that would suggest DPS of of TWD 3.82 in 2023 and TWD 4.44 in 2024. This would suggest dividend yields of 4.3% in 2023 and 5.0% in 2024 at current price of TWD 88.50.

O Ta Precision Industry Earnings & Dividends (Source: Smartkarma)

O-Ta Precision Industry Company Background

Founded in 1988, O-Ta Precision Industry's main products include golf clubs, bicycles, and related components. Among the golf clubs, the company specializes on the golf club heads, shafts, and club assembly. The company acts as OEM/ODM manufacturer of these products to some of the most well known golf brands including Titleist and Honma. O-Ta Precision Industry mainly distributes its products in Asian, American and European markets. The company was listed in the Taiwan stock exchange in 2000.

The global golf industry enjoyed tremendous boom during the COVID-19 pandemic period. One of the biggest reasons for this was due to many restrictions on indoor gatherings including working out at indoor gyms and health clubs. As a result, millions of golfers around the world flocked to outdoor sports including golf where there were fewer restrictions. In addition, there were a lot of government stimulus programs and many people ended up spending more money on golf equipment and apparel.

According to the World Golf Report, the global golf business (golf equipment and apparel sales) grew to just over $20 billion in 2021 and about $20 billion in 2022, which was more than a 30% increase since 2019. The U.S. accounted for 39% of the global golf business in 2022, followed by South Korea (29%), and Japan (16%). These three countries accounted for 86% of total global golf equipment and apparel sales in 2022.

The global golf equipment market was $14.8 billion in 2022, which is expected to growth at a CAGR of 2.3% per year from 2022 to 2033 (reaching $18.9 billion). Although the golf equipment market is not expected to grow as fast as the 2021 to 2022 period, it is expected to enjoy steady growth in the next decade driven by rising disposable income, increase in the number of golf courses (especially in developing countries), technological advancement in golf equipment, and increasing participation of women in golf.

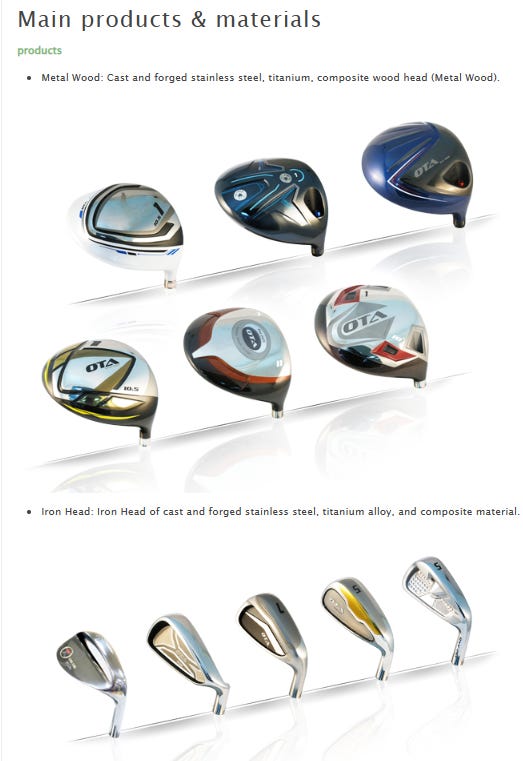

O-Ta Precision Industry golf clubs (Source: Company data)

O-Ta Precision Industry bicycles (Source: Company data)

Major Customers

The company's major customers include Titleist, PXG, Mizuno, Honma, Bridgestone, and Mitsubishi Chemical.

Source: Company data

O-Ta Precision Industry Product Technology Development

The chart below shows the golf club and bicycle development over the past several decades. From the early 1970s to early 1990s, the major golf club product technology change was the mass switch from wooden club head to stainless steel head. From 1990s to 2010s, the titanium plates were increasingly applied to the golf club heads.

In the past several years, carbon composite has become increasingly popular in golf club heads and clubs. Carbon composite includes a mixture of carbon with other materials including epoxy, ceramics, plastics polymers and fillers. This means a “graphite shaft” is actually a composite shaft made of carbon fibers fused with resin/epoxy. Carbon composite golf clubs have become more durable and consistent than the traditional steel based golf clubs. Many carbon composite golf clubs have various benefits including strength, flexibility, and durability.

Source: Company data

O-Ta Precision Industry Major Shareholders

World Commerce Enterprise BVI Co is the largest shareholder of O-Ta Precision Industry with a 9.1% stake, followed by Kung Wen Li (9.05%). Other major institutional investors that own this company include Capital Investment Trust Corp (2.6%), Yuanta Securities Investment Trust (2.2%), and Fuh Hwa Securities Investment Trust (1.7%).

Key Financials

The company's sales surged by 103.8% YoY to 7.9 billion TWD in 2021. Its sales flattened out at 7.7 billion TWD in 2022 and declined significantly by 41.6% YoY to 4.5 billion TWD in 2023. Net margin improved from 14.1% in 2020 to 21.4% in 2021 and 23.3% in 2022 but it is expected to decline to 10.3% in 2023.

O Ta Precision Industry Revenue, Net Income, & Net Margin (Source: Smartkarma)

O Ta Precision Industry Gross Profit & EBITDA (Source: Smartkarma)

O Ta Precision Industry ROA, ROC, and ROCE (Source: Smartkarma)

Balance Sheet Analysis - The company has a strong balance sheet. At the end of 3Q 2023, the company was in a debt cash position. Debt ratio (Total liabilities/equity) was 35% at the end of 3Q 2023. Net cash was 2,213 million TWD at the end of 3Q 2023, which represents 30% of its current market cap. The company's high net cash position provides a solid margin of safety.

O Ta Precision Industry Key Balance Sheet Items (Source: Smartkarma)

Cash Flow Statement Analysis - The company has consistently generated positive cash flow from operations and free cash flow from 2018 to 2022. Free cash flow yield was nearly 20% in 2022.

O Ta Precision Industry Key Cash Flow Statement Items (Source: Smartkarma)

O-Ta Precision Industry Valuations

O-Ta Precision is currently trading at P/E of 13.7x and EV/Sales of 1.6x based on consensus 2024 earnings estimates. From 2019 to 2023, the company's shares were trading at average P/E and EV/Sales multiples of 9.3x and 1.4x, respectively. Currently, O-Ta Precision Industry is trading at P/B of

Some of the global golf equipment related stocks include Acushnet Holdings (GOLF US), Topgolf Callaway Brands (MODG US), and Vista Outdoor (VSTO US). Unlike O-Ta Precision Industry, Acushnet, Topgolf Callaway Brands, and Vista Outdoor own their own golf equipment brands including Titlest - Acushnet, Topgolf Callaway Brands - Callaway, and Vista Outdoor - PING.

Share price comparisons (Acushnet, Topgolf Callaway Brands, Vista Outdoor) (1 year) - In the past one year, Acushnet and Vista Outdoor's share prices have performed well. Acushnet, Topgolf Callaway, and Vista Outdoor's share prices are up on average 14% in the past one year, outperforming O-Ta Precision Industry which is down 25% in the same period.

Share price comparisons (Acushnet, Topgolf Callaway Brands, Vista Outdoor) (1 year) (Source: Google finance)

Share Price Comparisons

The company's share price is down nearly 50% from its highs in July - October 2021. Although its share price is down significantly in the past two and half years, its share price is up 392% from end of 2018.

O-Ta Precision Industry share price trend (5 years) (Source: Yahoo finance)

Key Risk Factors

Slowdown on golf equipment spending after boom in 2021-2022 - Clearly, the spending on golf equipment globally has been slowing down this year after the boom in spending for them in 2021 and 2022.

The weak economic conditions and end of the social distancing measures resulting in people going back to indoor gyms to work out have been causing the slowdown in the golf equipment spending.

The economic conditions in three countries in particular including the United States, South Korea, and Japan are important since these three countries account for about 86% of the global golf equipment and apparel sales.

In addition, millions of golfers already purchased new golf clubs in 2021-2022 and typically these golf clubs last for several years before they purchase new ones.

Overall concerns on Taiwan/China political issues

Low liquidity - Given that this is a small cap stock in Taiwan, it has low shares trading volume. ADTV was 15.1 million TWD (US$0.5 million) in the past three months for this stock.

Finally....for the golf enthusiasts...a picture perfect swing compilation of Ben Hogan, who is probably one of the greatest ever golf ball strikers...

Source: Youtube

Disclaimer

The information contained on this website is not and should not be construed as investment advice. This insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Investors should make their own decisions regarding the prospects of any company discussed herein based on their own review of publicly available information.

The information contained on this website/newsletter has been prepared based on publicly available information and proprietary research. This insight does not contain and is not based on any non-public, material information. This publication makes no security recommendations whatsoever and is for educational purposes only. The opinions expressed in the publication are those of the publisher and are subject to change without notice. The information in the publication may become outdated and there is no obligation to update any such information.

The author does not guarantee the accuracy or completeness of the information provided in this insight. All statements and expressions herein are the sole opinion of the author and are subject to change without notice. It is highly advisable for you to do your own due diligence and invest at your own risk, independently of anything you may come across on this insight.

Any projections, market outlooks or estimates herein are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Readers and recipients are requested to consult with professional legal, tax, accounting, investment advisors before making any investment decisions. No part of this publication may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Douglas Research Advisory.

The author and the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein or may have such a position in the future. The author does NOT accept any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained on this website/newsletter.